people's pension higher rate tax relief

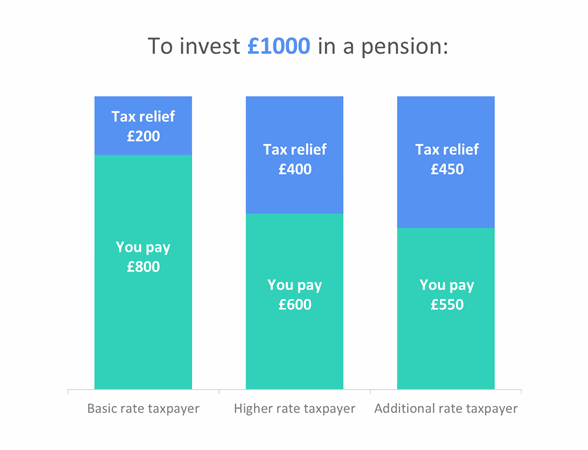

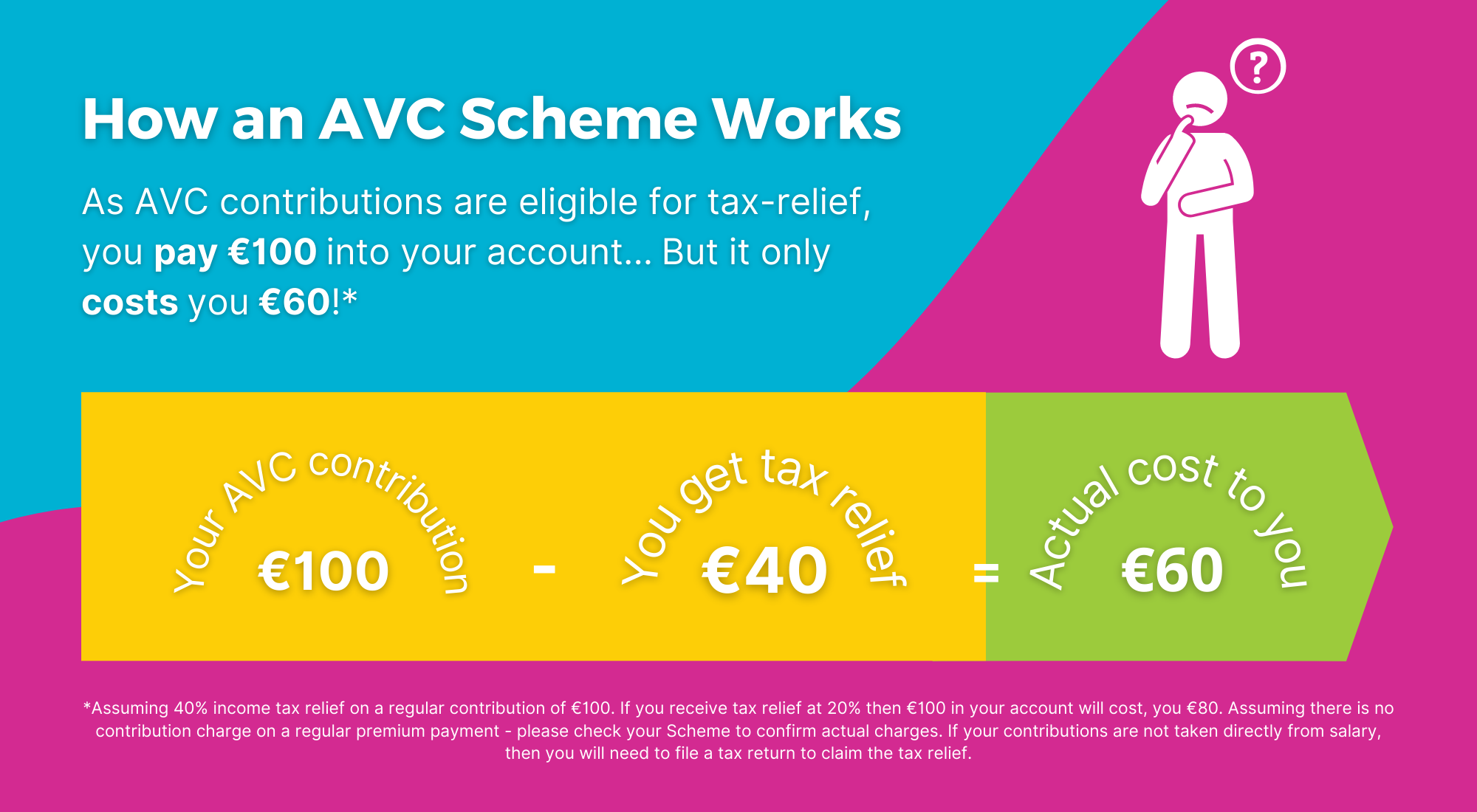

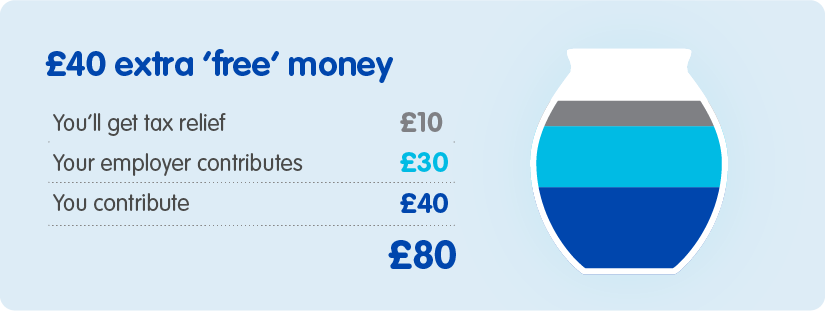

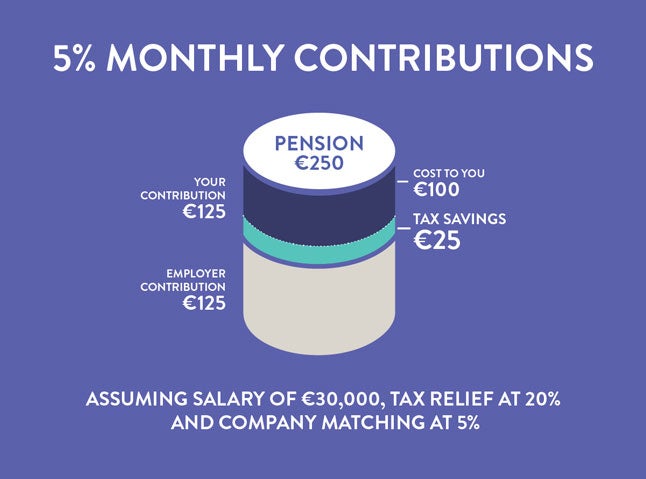

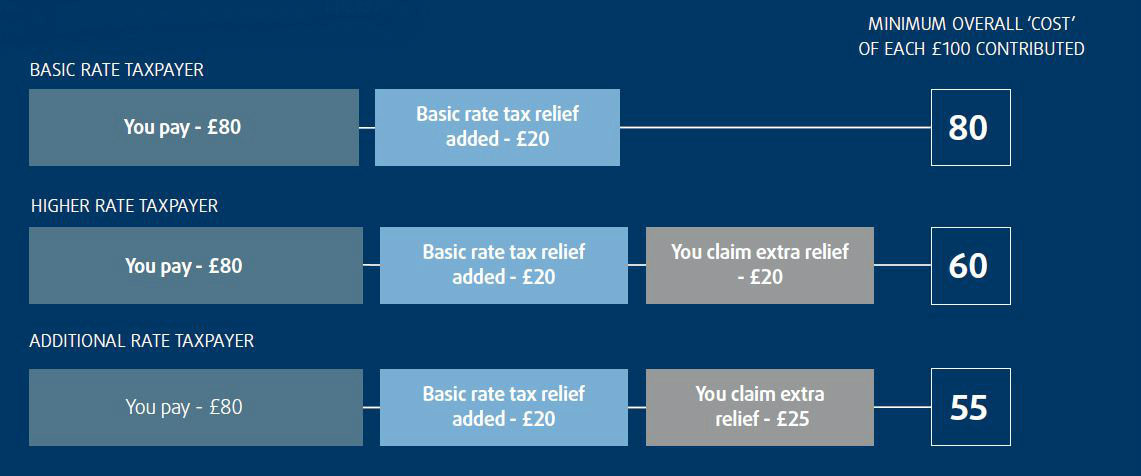

15 where the taxable income does not exceed EUR 175000. Effectively free cash from the Government paid into your pension based on your income tax rate of 20 per cent 40 per cent or 45 per cent.

California Tax Relief What S In The Deal Calmatters

These include income you received from a foreign-sourced pension plan.

. Pension tax relief. Where peoples annual. Weve found some of the best ones by their compound annual growth rate.

Foreign tax credit without Form 1116. Looking for the best pension fund to invest your pension in. This will mean that the maximum youll be.

The effective rate is the total tax paid divided by the total amount the tax is paid on while the marginal rate is the rate paid on the next dollar of income earned. Income becomes highly taxed for IRS purposes when the foreign countrys tax rate is higher than the US. 17 where the taxable income exceeds EUR 200000.

Minimum amount of tax. If youre only taking the 25 tax-free pension lump sum youll still be able to contribute up to 40000 a year into a pension and earn pension tax relief. You were required to leave the Peoples Republic of China excluding the Special Administrative regions of Hong Kong.

Corporate income tax for resident and non-resident companies has been set at the following rate in 2019. An additional charge of 7 is levied on corporate income tax as a contribution to the employment fund. One thing to note.

For example if income is taxed on a formula of 5 from 0 up to 50000 10 from 50000 to 100000 and 15 over 100000 a taxpayer with income of 175000 would pay a total. Toggle menu toggle menu path dM526178 313114L447476 606733L741095 685435L819797 391816L526178 313114Z fillF9C32D. But if you take an uncrystallised fund pension lump sum youll trigger something called the money purchase annual allowance.

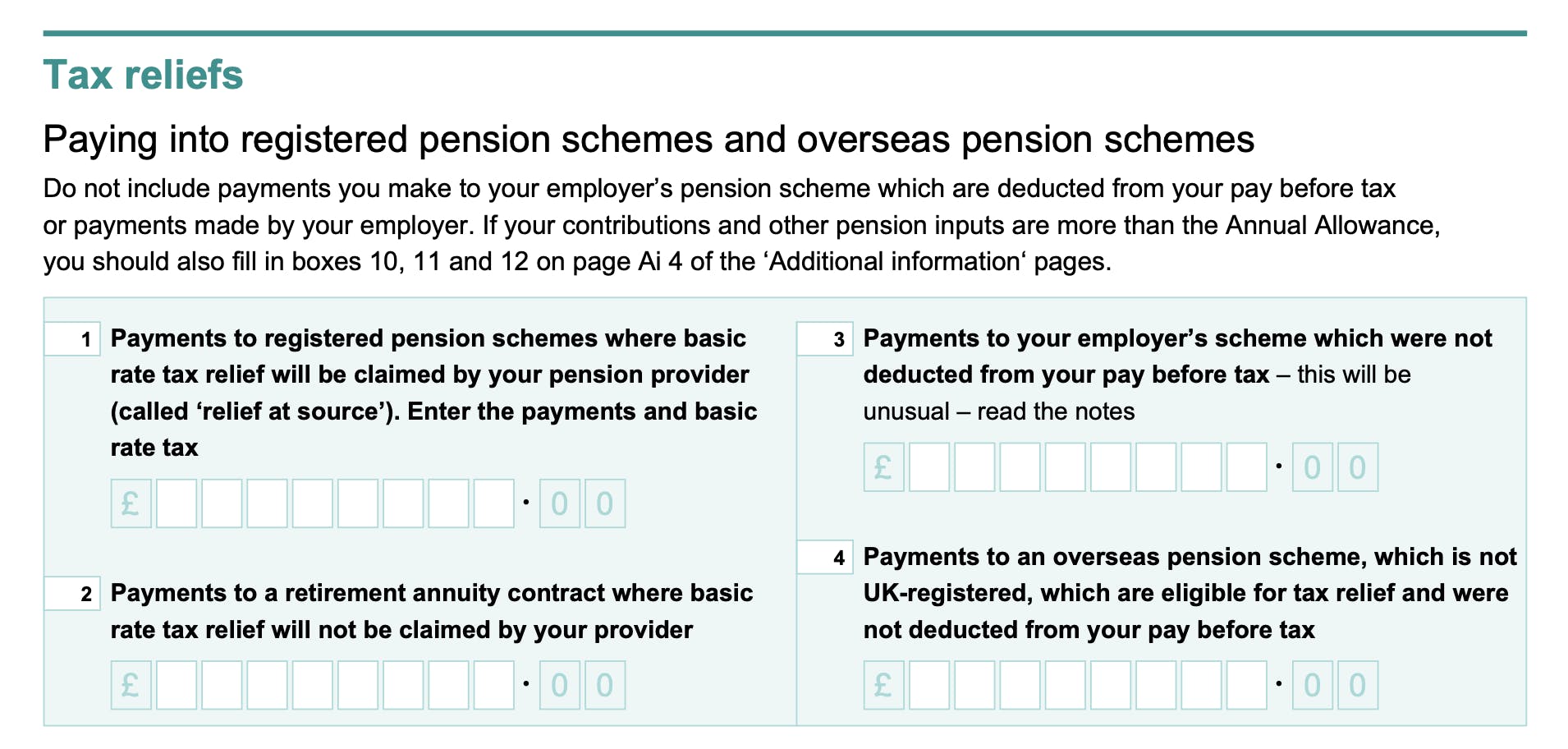

How To Add Pension Contributions To Your Self Assessment Tax Return

How Pension Tax Relief Works And How To Claim It Wealthify Com

Pennsylvania S Property Tax Rent Rebate Program May Help Low Income Households Legal Aid Of Southeastern Pennsylvania

Higher Income Tax How To Claim Pension Tax Relief Extra 20 Boost Youtube

How To Get 61 5 Tax Relief On Pension Contributions Royal London For Advisers

Pension Tax Relief On Pension Contributions Freetrade

Employee To Partner Pension Contributions And Tax Considerations

How To Claim Higher Rate Tax Relief On Pension Contributions Unbiased Co Uk

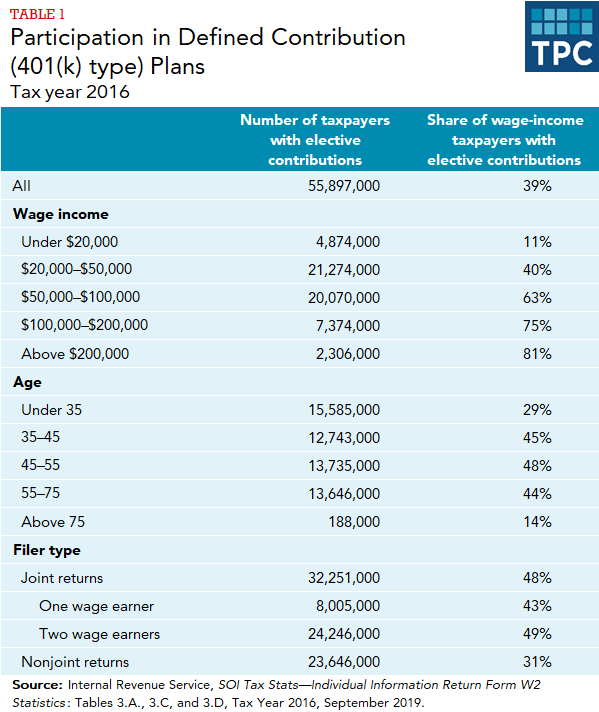

What Are Defined Contribution Retirement Plans Tax Policy Center

Pension Tax Relief On Pension Contributions Freetrade

Pension Tax Relief On Pension Contributions Freetrade

Avc Pension What Are Avcs How To Maximise Pension Benefits

Opting Out The People S Pension

Your Handy Guide To Company Pensions

.jpg)

Benefits Of Saving Through Your Pension Phoenix Wealth

Sipp Tax Relief Calculator Tax Relief On Pension Contributions

Pension Tax Relief On Pension Contributions Freetrade

Hogan And Legislative Leaders Announce Agreement On Tax Relief 2023 Spending Maryland Matters